Is Now a Good Time to Sell in Markham, Ontario? Analyzing the 2025 Spring Market Trends

Is Now a Good Time to Sell in Markham, Ontario? Analyzing the 2025 Spring Market Trends

Imagine standing at a crossroads: sell your Markham home now amid shifting tides or wait for calmer waters? With spring traditionally hailed as prime selling season, the 2025 market tells a more nuanced story. Let’s unpack the data, weigh the risks, and uncover whether this moment aligns with your goals.

Current Market Dynamics: A Buyer’s Playground

Markham’s housing market is firmly in buyer’s territory as of April 2025. Key indicators reveal:

- Price Declines: The average home price dropped 9.9% year-over-year (YoY) to $1.21M in March 2025, with sharper declines than the broader GTA (-2.5% YoY).

- Inventory Surge: Active listings surged 31.4% YoY to 569 homes, creating a surplus that pressures sellers to compete.

- Slower Sales: Only 220 homes sold in March 2025, a 28.3% YoY drop, while properties linger longer (median 21 days on market) .

Detached homes, once Markham’s crown jewels, saw the steepest declines, averaging $1.64M (-11.1% YoY), while condos showed mixed resilience with a 3% monthly price uptick.

Seasonal Trends: Spring’s Silver Lining?

Spring typically brings a surge in buyer activity, and 2025 is no exception—but with caveats:

- New Listings Spike: March–April 2025 saw 832 new listings in 28 days, up 52% YoY, signaling seller urgency.

- Negotiation Leverage: Buyers hold the cards, with the sales-to-new-listings ratio (SNLR) at 34% in Ontario far below the 40% threshold for a balanced market.

While spring demand may shorten selling times, sellers must price aggressively. A Markham home recently reduced its asking price by $50K to attract interest, a common tactic in today’s climate.

Economic Headwinds and Rate Cuts: A Double-Edged Sword

The Bank of Canada’s rate cuts to 2.75% in March 2025 aim to stimulate demand, but broader uncertainties linger:

- Tariff Tensions: U.S. trade policy and Canada’s federal election (fall 2025) fuel buyer hesitancy

- Job Market Jitters: Ontario’s weakening employment sector could dampen buyer confidence despite lower borrowing costs .

Economists remain divided:

- TD Economics predicts further price declines in 2025 due to economic risks.

- CREA foresees a sales rebound later in the year as pent-up demand meets lower rates .

Property-Specific Insights: What’s Selling (and Struggling)?

- Detached Homes: Down 11.1% YoY, these face the toughest competition. A 4-bedroom home now averages $1.6M, down 12% YoY.

- Condos: Mixed performance, 2-bedroom units fell 6% YoY to $1.1M, while 3-bedroom condos rose 19% monthly to $964K.

- Townhouses: Semi-detached homes dipped 5% YoY to $1.3M, reflecting broader affordability challenges.

The Verdict: To Sell or to Wait?

Sell Now If:

- You need liquidity or are downsizing.

- Your property stands out (e.g., renovated, prime location).

- You’re prepared for negotiations (homes sell at 98–102% of listing price on average) .

Wait If:

- You can afford to hold until late 2025, when post-election clarity and further rate cuts (forecasted to drop 0.75% by 2026) may stabilize prices.

- Your home type (e.g., condo) shows signs of recovery.

Strategic Tips for Sellers:

- Price Realistically: Benchmark against recent sales, not 2024 peaks.

- Stage for Speed: Highlight move-in readiness; 20% of buyers prioritize turnkey homes.

- Leverage Spring Momentum: List in April–May before summer slowdowns.

- Monitor Rates: The Bank of Canada’s April 16 announcement could sway buyer urgency .

Final Thoughts

Markham’s 2025 spring market offers *opportunity amid uncertainty*. While buyers dominate today, strategic sellers can still thrive—provided they adapt to the new normal. Whether you sell now or wait, let data, not emotion, guide your decision.

Categories

- All Blogs (55)

- Activities (3)

- Bank of Canada (1)

- Buying (10)

- Canada (21)

- Canada Economy (5)

- Condo (3)

- Debate (1)

- downsizing (2)

- Economy (7)

- empty nesters (1)

- Events (2)

- Family (6)

- Family Activities (3)

- February (4)

- First Time Homebuyer (4)

- For lease (1)

- gst cut (1)

- High Demand (7)

- home (20)

- Home Improvement (13)

- Home Selling (21)

- Home tips (17)

- Homebuying (19)

- House for sale (14)

- housing crisis (2)

- Inclusive Community (7)

- Job Opportunities (1)

- March (4)

- March Break (2)

- Markham (24)

- Markham, Ontario (19)

- PM Carney (2)

- policy (2)

- real estate (14)

- retirees (2)

- revenue (2)

- Rezoning (1)

- Rezoning Debate (1)

- Schools (3)

- Selling (14)

- Snake Zodiac (1)

- spring (8)

- Springfest (1)

- Tariff (2)

- Top-Ranked Schools (2)

- Toronto (20)

- Trump (1)

- Weekends (1)

- Winter (4)

- Winter Tips (4)

- Year of the Snake (1)

Recent Posts

Travel: The Ultimate Investment in Yourself!

Is Now a Good Time to Sell in Markham, Ontario? Analyzing the 2025 Spring Market Trends

Discover Markham, Ontario: Your Family-Friendly Haven with Parks, Top Schools, and Smart Living

How AI is Revolutionizing Markham’s Real Estate Market: A Tech-Savvy Transformation

Modern Comfort & City Convenience: Stunning 2-Bedroom Condo for Lease at 60 Ann O’Reilly Rd

Trump’s 25% Tariffs: The Ripple Effect on Toronto-Markham Real Estate and GTA Jobs

Markham Real Estate 2025: Will Prices Chill or Sizzle? Your Coffee Break Guide to Buying, Selling, & Winning

The GST Cut Everyone’s Celebrating But Could Backfire….Here’s Why.

Spring into Your First Home: Top 3 Blooming Neighborhoods for 2025 Buyers in Markham, ON

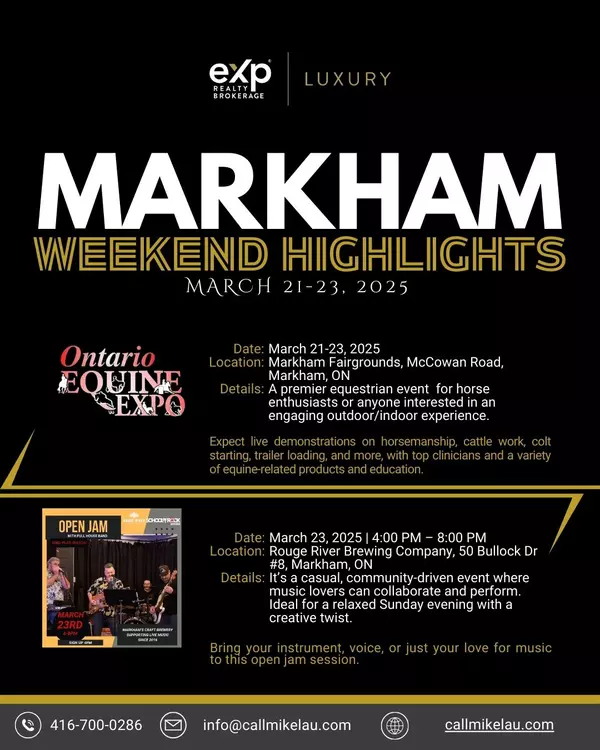

Markham Weekend Highlights: Unleash Family Fun at the Ontario Equine Expo & School of Rock Open Jam!